Following the announcement of LeadBlock Partners first investment in Connecting Food, I wanted to take this opportunity to share our thoughts on why we invested.

‘Behind the scene’ of LeadBlock Partners first investment: Connecting Food

ESG (Environmental, Social, Governance) and sustainability-related topics are at the heart of who we are and what we do. We truly believe that tech has an important role to play to achieve the UN Sustainable Development Goals (more here).

We are taking an active role in re-imagining today’s world by investing in disruptive start-ups to solve global challenges. We believe blockchain and distributed ledger technologies have unprecedented potential to reshape how businesses are run, making them more equitable, and transparent.

A blockchain is a type of database where data is grouped into blocks and linked together by cryptography creating a secured chain of blocks. Benefits include immutability, decentralization, auditability and automation.

LeadBlock Partners led Connecting Food €2.1mn pre-Series A round, alongside repeat angel investors whom have been backing the founders since the start. We joined Connecting Food as Board member.

Stephane Volpi (left) and Maxine Roper (right), co-founders of Connecting Food

Founded in 2016 by two experienced professionals from the food industry, Connecting Food builds consumer trust in food by not only tracking but more importantly digitally auditing products in real-time using blockchain technology. The start-up recently announced a number of contracts with industry leaders including Mondelez, Herta (Nestlé) and Axereal.

Real challenges to overcome in the food industry

Based on our discussions with industry experts and through our past investments, we have identified a number of challenges in the food industry. These challenges have been increasing over time and feedback from industry insiders suggests a pressing need for change and innovation.

(1) Consumers lack trust in brands and retailers

Now more than ever, consumers are asking for more transparency and visibility in food supply chains, lacking trust in brands and retailers.

“Only 1/3 of consumers trust food brands and 3/4 say they’ll switch to a brand that provides more in-depth product information”

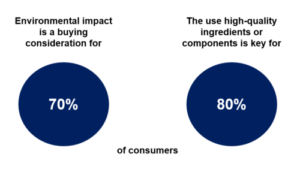

Globally, environmental impact is a buying consideration for c.70% of consumers and the use high-quality ingredients or components is key for c.80%¹. However, consumers struggle to have visibility and trust in production practices.

Globally, environmental impact is a buying consideration for c.70% of consumers and the use high-quality ingredients or components is key for c.80%¹. However, consumers struggle to have visibility and trust in production practices.

Ensuring that each product does respect commitment, specifications and practices on the label is a significant challenge for the food industry. According to a study from the Food Market Institute², only 1/3 of consumers trust food brands and 3/4 say they’ll switch to a brand that provides more in-depth product information, beyond what’s provided on the physical label.

According to surveys conducted by the “Bureau Européen des Unions de Consommateurs” members (BEUC), in European countries like Germany and the Netherlands, less than 20% of consumers trust food labels³. In France, 34% of consumers trust organic food labels⁴, versus 26% in the US⁵.

Moreover, consumers’ trust in brands and labels is low, and continues to fall. A 2018 survey reveals that only 33% of consumers trust the food they are buying, compared to 47% just a year ago⁶.

How did consumers’ trust in brands and labels fade away?

Looking at the past two decades, we can list numerous (and disastrous) cases of food safety and fraud scandals, including the 2013 horse meat scandal in Europe, the 2018 E. coli lettuce scandal in the US, or more recently the 2019 ‘sick cow’ meat scandal in Poland.

Taking the example of the 2013 horse meat scandal, in our view the scale of such fraud would have been smaller with a real time digital tracking and live audit platform. With constant checks on inputs and outputs, intermediaries would have found difficult to prove that they had bought beef meat, therefore raising a red flag.

(2) Product recalls are costly, leading to food waste, financial and brand damages

“A product recall has an estimated direct cost of $10mn and indirect cost of $100mn including lost revenues due to significant reputational damage”

Product recalls are particularly risky for brands which spend years and millions on marketing to build unique identities and differentiate from generic/store brands. The actual products are very similar (as per blind tests) but their brands allow them to price products higher and sustain competition. However, if trust is breached then the unique identity benefits are lost.

In the US, a product recall has an estimated direct cost of $10mn and indirect cost of $100mn including lost revenues due to significant reputational damage⁷.

In addition to brand and financial damages, recalls (i.e. E. coli lettuce, Salmonella beef, horse meat scandal) are also leading to enormous volumes of food waste. For instance, the 2013 horse meat scandal resulted in a 50mn kg of food recall.

(3) Food auditors can’t follow market growth

Demand for more transparency, traceability and quality is emerging from all parts of the food industry, from consumers, retailers, brands, producers. As of today, the global food certification market is worth c.$10bn and is expected to grow at +5% pa by 2025⁸ (one of the fast verticals of the Testing, Inspection, and Certification — TIC — industry).

However, this growth is facing a major bottleneck on the supply side — to find adequate and skilled labour human resources (i.e. food auditors) — leaving <5% of food production volumes audited.

Europe accounts for the largest share of the global food certification market, followed by North America. In both regions, stringent policies and food standards have been implemented to ensure quality in the supply chain. This is also increasingly the case in developing countries, driving further market growth.

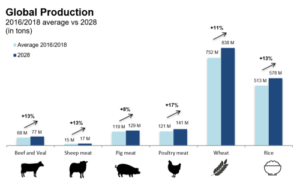

‘Food Outlook: Biannual Report on Global Food Markets’ FAO (United Nations), November 2019

While global food production (i.e. wheat, rice) is expected to rise by 10%+ by 2028⁹, the food certification market continues to face human resources constraints. In fact, physical food auditors cannot cover a larger share of the production and cannot verify in real-time.

We believe technology could help physical food auditors capture this growing market opportunity, while also increasing their coverage from <5% of volumes today to 100% tomorrow.

Why can’t retailers/brands create that solution themselves?

In short, the answer is independence.

First, the auditor needs to be independent for its opinion to be valid in the eyes of the industry, the consumers and the regulators. Second, industry participants don’t want to use the platform of another industry participant even if they are not competitors (different supply chain levels). They don’t want to give out or share so much information.

(4) Farmers and growers, at the heart of food quality, often left out

Farmers and growers are at the heart of food quality. Sustainable practices can sometimes incur additional costs, putting more pressure on farmers and growers’ margins. We view technology as an enabler to a fairer and more sustainable way of doing business.

The worst part is that farmers who produce high quality food sustainably often struggle to differentiate themselves. This in turn disincentives these sustainable practices as they are not rewarded.

5% of Connecting Food turnover is donated to farmers to reward them for the quality of their work and to value agricultural data

Food quality is highly related to farm produce, reason why farmers and growers are a major focus for Connecting Food. To reward them, Connecting Food is donating 5% of its turnover to farmers and growers for the quality of their work and to value agricultural data.

Connecting Food: on a mission to bring back trust in the food industry

Connecting Food offers a blockchain solution to address those three challenges, by tracking and digitally auditing food supply chains in real-time. The digital auditing module “LiveAudit®” is their breakthrough innovation: it brings food auditing to the digital age, strengthening occasional auditor visits with continuous real time digital verifications. It allows producers, brands & manufacturers, and retailers to prove to their clients that each product really does respect commitment, specifications and practices listed on the label.

Why have we invested in Connecting Food?

Let’s first go back a couple of years ago, when our senior partner Jean-Marc invested in a start-up developing sensors for the food industry. This is when we started to discuss about blockchain and distributed ledger technology as a mean to secure data.

Since then, we have screened a large number of start-ups, projects, governmental initiatives in the food industry but quickly realised that most of them were only focusing on traceability. Considering previous fraud scandals and consumer trust challenges, would more transparency in the food supply chain be enough? Something was missing.

Traceability of products is a good start, but not enough to overcome the challenges faced by the food industry. We were on the hunt for the missing piece of the puzzle, until we spoke to Maxine and Stefano, co-founders of Connecting Food.

Why have we invested?

(1) We have identified an immense market opportunity. (2) Connecting Food solves each of the industry challenges identified above, (3) with a proprietary & disruptive technology behind a scalable product, and (4) backed by a diverse and well seasoned team of professionals. Last but not least, (5) not only will Connecting Food bring back trust in the food industry, but it will reshape how businesses are run, making them more equitable, and transparent.

About LeadBlock Partners

LeadBlock Partners is an early stage venture capital fund focused on the enterprise blockchain space in Europe. The fund invests in B2B businesses which use blockchain or distributed ledger technology to solve digitalisation challenges and unlock new markets. It was founded in early 2019 by a team of three experienced industry and investment professionals including two ex-Goldman Sachs.

The team decided to launch an enterprise blockchain fund as (1) they identified a clear funding gap in the space for non-crypto related blockchain start-ups, (2) saw first-hand the strong corporate interest for distributed ledger technology & blockchain solutions, and (3) believe this disruptive technology will reshape how businesses are run, making them more equitable, and transparent.

The fund has three founding partners, Jean-Marc Puel, David Chreng-Messembourg and Baptiste Cota.

Sources

¹ 2019 Edelman Trust Barometer Special Report

² ‘The transparency imperative: Product Labeling from the Consumer Perspective’, Food Market Institute, Label Insight, 2018

³ ‘Consumers do not trust food labels and they have good reason’: EU consumer organisation calls for tougher labelling regulation, 13th June 2018

⁴ ‘Pourquoi le bio fait toujours face aux doutes des consommateurs’, Challenges, 20th February 2020

⁵ ‘Produce tops grocery lists for organic food shoppers’, Mintel report, 9th August 2017

⁶ ‘Study by Center for Food Integrity’, 2018

⁷ Harris interactive poll, Joint study for Food Marketing Institute & Grocery Manufacturers Association, December 2018

⁸ ‘Food Certification Market Analysis, Size, Share, Growth, Trends and Forecast to 2025’, Kenneth Research Food Certification Market Analysis, Size, Share, Growth, Trends and Forecast to 2025, November 2019

⁹ ‘Food Outlook: Biannual Report on Global Food Markets’ Food and Agriculture Organisation of the United Nations, November 2019